Over 2 million + professionals use CFI to learn accounting, financial analysis, modeling and more. Unlock the essentials of corporate finance with our free resources and get an exclusive sneak peek at the first module of each course. Start Free

Current liabilities are financial obligations of a business entity that are due and payable within a year. A liability occurs when a company has undergone a transaction that has generated an expectation for a future outflow of cash or other economic resources.

The key operator in this definition is the word “expectation,” as a liability does not necessarily always have to end up resulting in an outflow of value, but must be reasonably expected to, on recognition of the liability.

While a current liability is defined as a payable due within a year’s time, a broader definition of the term may include liabilities that are payable within one business cycle of the operating company. In other words, if a company operates a business cycle that extends beyond a year’s time, a current liability for said company is defined as any liability due within the longer of the two periods.

Current liabilities are critical for modeling working capital when building a financial model. Transitively, it becomes difficult to forecast a balance sheet and the operating section of the cash flow statement if historical information on the current liabilities of a company is missing.

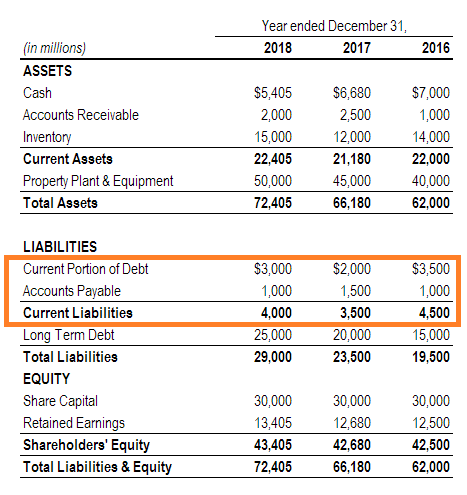

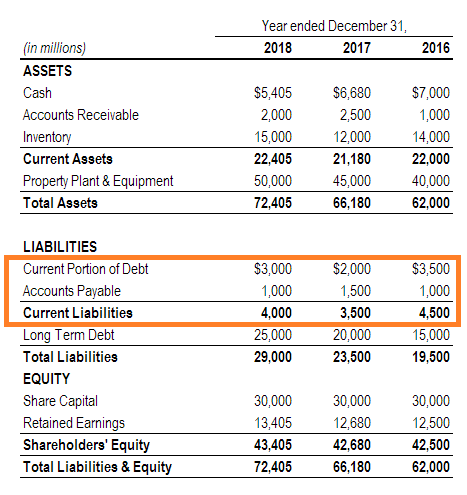

Not surprisingly, a current liability will show up on the liability side of the balance sheet. In fact, as the balance sheet is often arranged in ascending order of liquidity, the current liability section will almost inevitably appear at the very top of the liability side.

Enter your name and email in the form below and download the free template now!

A company incurs expenses for running its business operations, and sometimes the cash available and operational resources to pay the bills are not enough to cover them. As a result, credit terms and loan facilities offered by suppliers and lenders are often the solution to this shortfall.

A company will also incur a tax payable within any operating year that it makes a profit and, thus, owes a portion of this profit to the government.

There are various categories of current liabilities. The most common is the accounts payable, which arise from a purchase that has not been fully paid off yet, or where the company has recurring credit terms with its suppliers. Other categories include accrued expenses, short-term notes payable, current portion of long-term notes payable, and income tax payable.

These are all important factors for forecasting and valuation.

CFI is the official provider of the global Commercial Banking & Credit Analyst (CBCA)™ certification program, designed to help anyone become a world-class financial analyst. To keep advancing your career, the additional resources below will be useful:

Learn accounting fundamentals and how to read financial statements with CFI’s online accounting classes.

These courses will give you the confidence to perform world-class financial analyst work. Start now!

Boost your confidence and master accounting skills effortlessly with CFI’s expert-led courses! Choose CFI for unparalleled industry expertise and hands-on learning that prepares you for real-world success.